who pays sales tax when selling a car privately in texas

You can find these fees further down on. Take off your plates step 5.

13 Surprising Tips For Selling Your Old Car According To Experts

The buyer will then most likely be required to pay use tax on the amount that heshe paid for your vehicle.

. Collect sales tax on the purchase. Remember in this example the price of the trade-in is deducted from the price of the new car for tax purposes. Forget to give the customer the signed original Form 14-312 with instructions to provide Form 14-312 to their states vehicle registration division.

Instead the buyer is responsible for paying any sale taxes. The Texas DMV recommends going with the buyer to your local county tax office to ensure that the application for a new car title has officially been filed. New car purchase price 30000.

However you do not pay that tax to the car dealer or individual selling the car. Total cost of new car. Texas collects a 625 state sales tax rate on the purchase of all vehicles.

The sales tax for cars in Texas is 625 of the. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Used car sold by owner. If the seller is not a Texas licensed dealer the purchaser is responsible for titling and registering the vehicle as well as paying the tax to the local county tax assessor-collector CTAC within 30 calendar days of the purchase date.

The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the. Income Tax Liability When Selling Your Used Car. However if you sell it for a profit higher than the original purchase price or what is.

That tax rate is 725 plus local tax. Once you have sold your vehicle you need to report the sale to the Department of Transportation. Active-duty military personnel have 60 calendar days to title and register a vehicle.

Selling A Junk Car In Texas. Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets.

The average sales tax rate on vehicle purchases in the United States is around 487. Does that mean you have to pay property tax on a leased vehicle. The buyer will have to pay the sales tax when they get the car registered under their name.

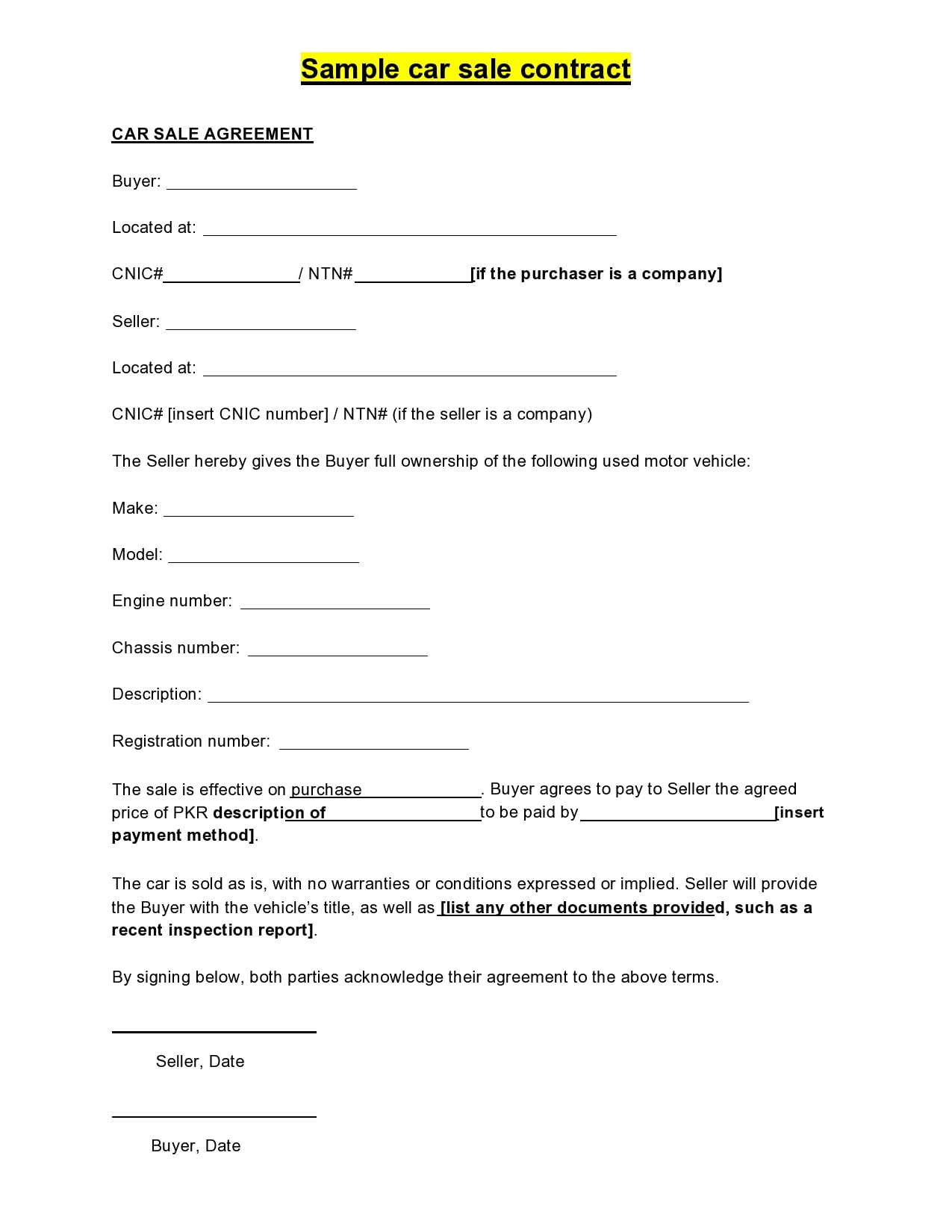

When an illinois resident purchases a vehicle from an out of state dealer and will title the car in illinois the sale and subsequent tax due is reported on form rut 25 when you bring the vehicle into illinois. Taxes paid 7 of 30000. Be sure the seller signs dates and enters the sales price on Form 130-U.

You will pay it to your states DMV when you register the vehicle. If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle is titled. Collect 5 for the Buyers Tag.

Selling a junk car in the state of Texas is an entirely different matter. A used car in texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price. Learn how to sell your used car or truck privately in Texas.

Motor vehicle sales tax is the purchasers responsibility. If you sell it for less than the original purchase price its considered a capital loss. Sell a car in texas.

Reporting the Sale for Tax Purposes. The most expensive standard sales tax rate on car purchases in general is found in California. With an estimated 14 million registered trucks and cars in the state of Texas it is no wonder that thousands of private car owners from the Lone Star state have used Autotrader to sell their car.

The title registration and local fees are also due. When reporting the sale you should also inform the DOT of the selling price of the vehicle. But when it comes to selling a.

Some dealerships may charge a documentary fee of 125 dollars. If you purchased the car in a private sale you may be taxed on the purchase price or the standard presumptive value SPV of the car whichever is higher. For example sales tax in California is 725.

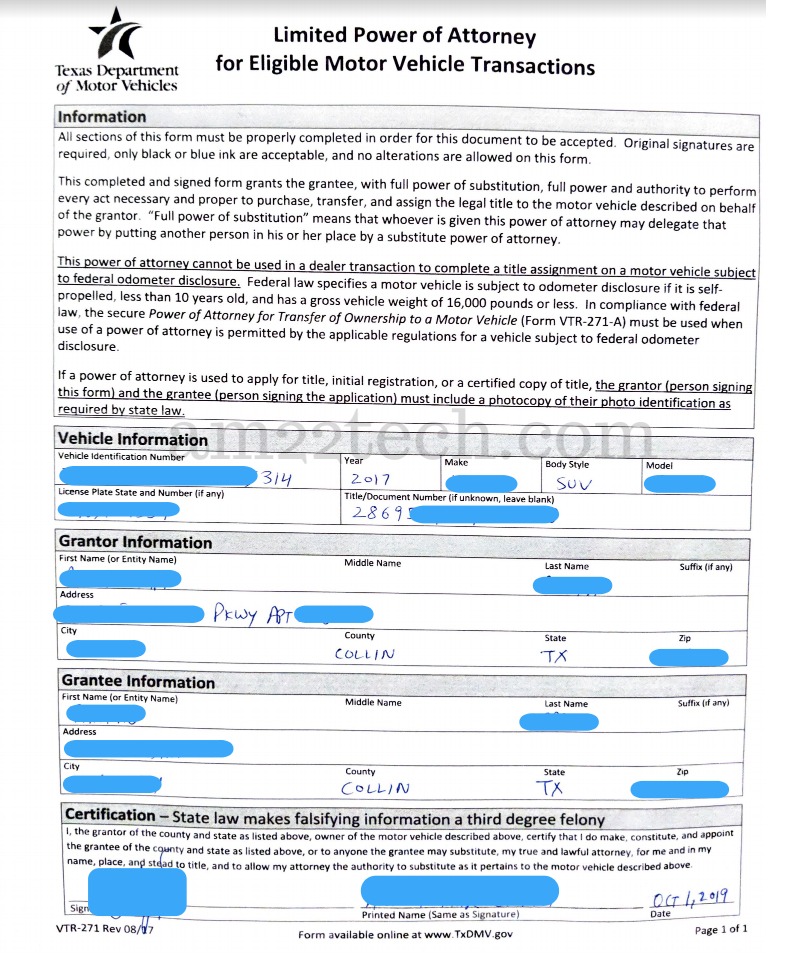

If you are purchasing the vehicle out of state have the seller download the form from the Texas Department of Motor Vehicles website wwwTxDMVgov. If you are legally able to avoid paying sales tax for a car it will save you some money. Go to your local county tax office within 30 days to title the vehicle in your name.

In light of this youll need to have a good idea of what your car is worth in scrap in order to negotiate a sale price. A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price. Once the buyer has the vehicle registered under his name he must pay to sell Texas.

Have the customer sign Form 14-312 Texas Motor Vehicle Sales Tax Exemption Certificate- for Vehicles Taken Out of State. According to the Texas Department of Motor Vehicles any person that buys a car in Texas owes the government a motor vehicle sales tax. New car purchase price.

This means you do not have to report it on your tax return. 32100 16000 16100. In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees.

Clean your car as much as you can. If you purchase a used Honda Civic for 10000 you will have to pay an. How Much is the Average Sales Tax Rate on Cars.

Who pays sales tax when selling a car privately in illinois. In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay. Do not let a buyer tell you that you are supposed to.

For additional tips on protecting yourself and securing a safe and profitable sale our Guide to Selling Your Car offers answers from the first step to the last. Used cars have had at least one other owner meaning they have history. The steps and process for selling a vehicle online are different in every state.

In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were buying it. However certain states have higher tax rates under certain conditions. If I sell my car do I pay taxes.

Typically junk car sellers are looking to offload their vehicles to a scrapyard or junkyard rather than a private buyer.

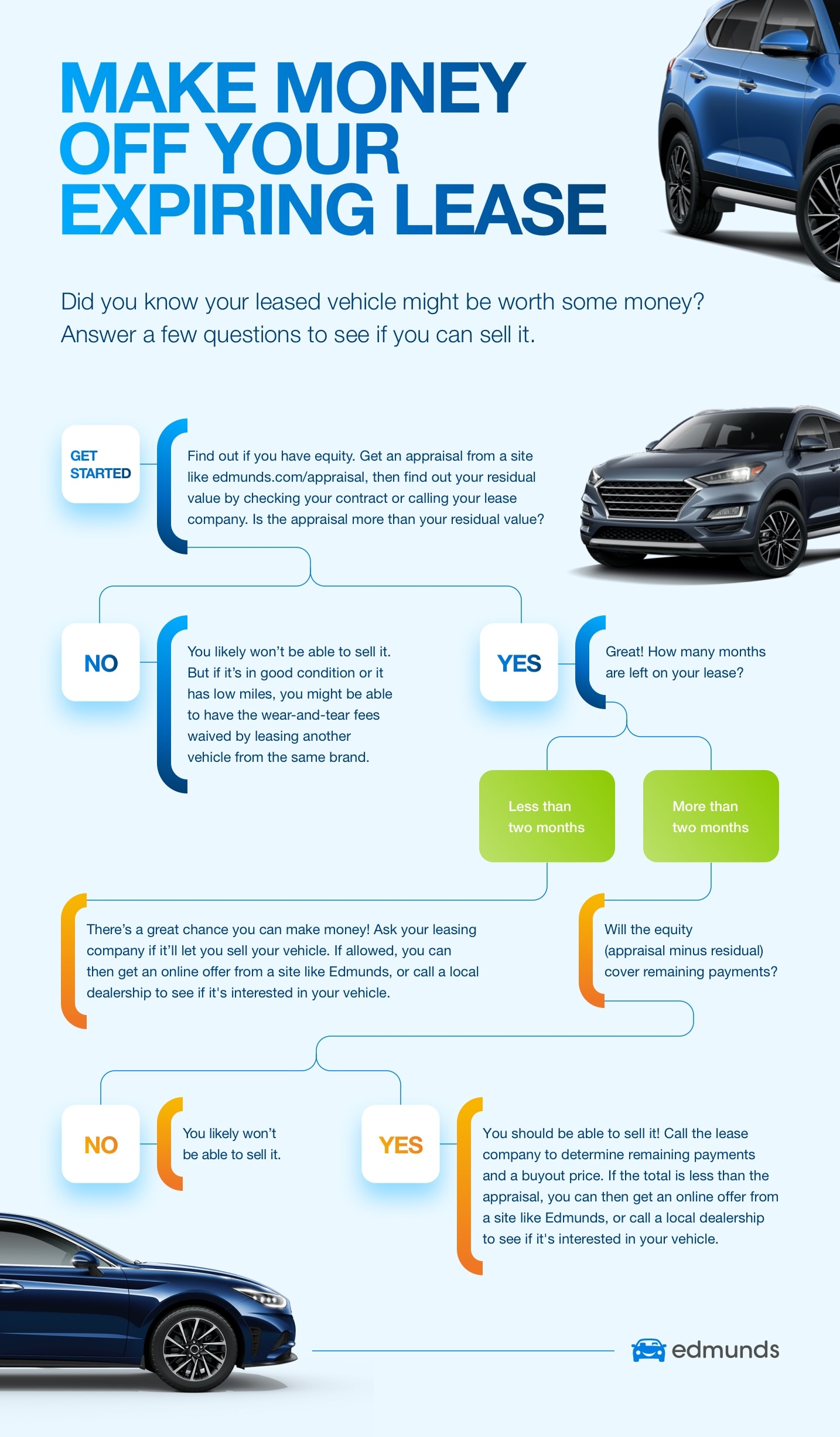

Consider Selling Your Car Before Your Lease Ends Edmunds

How To Buy And Sell Cars Without A Dealers License Sane Driver

Free Vehicle Private Sale Receipt Template Word Pdf Eforms

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

6 Steps To Limit Risk When Selling Your Car Privately Driveo

Sample Car Sale Contract Form 5 Free Templates In Pdf Word Vehicle Selling Agreement Template Example Project Cars For Sale Cars For Sale Cars For Sale Used

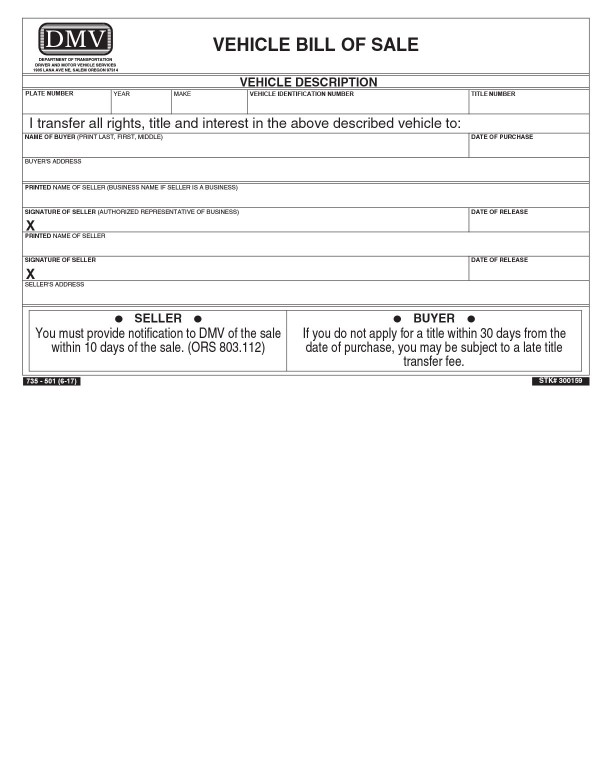

Free Vehicle Bill Of Sale Form For A Car Pdf Word

Trade In Car Or Sell It Privately The Math Might Surprise You

Sell Car In Usa With Power Of Attorney Virtual Notary Allowed Usa

30 Simple Car Sale Contract Templates 100 Free

Sell Car In Usa With Power Of Attorney Virtual Notary Allowed Usa

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

Nj Car Sales Tax Everything You Need To Know

Free Vehicle Private Sale Receipt Template Word Pdf Eforms

/162971_VE-ALT_howToSellCar-5a8dd0c4d8fdd50037949800.jpg)